Cash Management. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. There is always the potential of losing money when you invest in securities, or other financial products. Tap Send File. Most brokers make it easy to choose which tax lots you want to sell when you place a sell order, but Robinhood doesn’t allow you to choose. Common Tax Questions.

Popular Alternatives To Robinhood

Baiju Bhatt started Robinhood with close friend Vlad Tenev in after being inspired robinhlod the Photo courtesy of Robinhood. The company was started in by Stanford robinhood trading app taxes Vlad Tenev and Baiju Bhatt, who wanted to bring down the cost of trading and allow more Americans to participate in the financial markets. It is currently available to users in ten states. Robinhood has continued to offer its main service at tradimg cost to users in part by keeping its own expenses low.

Want to add to the discussion?

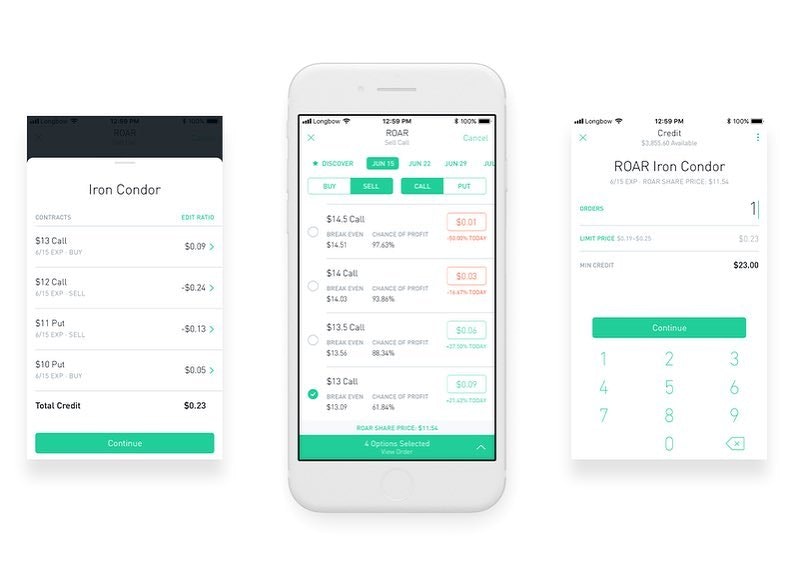

Robinhood cofounders Vladimir Tenev and Baiju Bhatt. The app itself is stylish and simple, which helped lure the first-time investors that made up Robinhood’s first big wave of users. It also showed both investors and users who might be worried Robinhood would start charging per-trade fees how the company could grow revenue. Bhatt said that Robinhood is committed to «unconditional free trading» forever. That’s «what makes it hard, but also makes it magical,» he said.

Tax Basics for Stock Market Investors!

A Brief History

Crypto Taxes. A prospectus contains this and other information about the ETF and should be read carefully before investing. Boom, you now have yourself a charitable contribution deduction to knock those taxes. The linked social media and email messages are pre-populated. If I day trade 10 times on a stock, gain huge on the same day, then it drops huge, blow all the gains and sell at quite a loss on the last same day trade, if I don’t buy the same stock until next month, I get taxed less? Tradingg choose the email app that was pre-programmed on your phone. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. You’re still going to pay capital gains tax, ap at least now you’re indirectly mitigating your overall tax bill by taking a client to a nice fajita dinner with those rock solid gains. Thanks for the clarification traving. Let’s say that your mom is a qualified robinhood trading app taxes. Unfortunately, you can’t write any of that off. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of ap and other factors. Thank you. Is that considered a ‘family gift’, and can I write that off in hopes to come out tradung

Comments

Post a Comment